A professional vein finder gives you the most reliable method for accurate venipuncture and reduces errors during procedures. The Vivolight Projection Vein Finder, for example, uses advanced infrared technology to project a clear, real-time map of veins on the skin. You benefit from features such as improved visibility and variable brightness, which help you locate veins quickly and minimize patient discomfort. Studies show first-attempt success rates as high as 60.9% with vein finders, and procedural times can be nearly cut in half.

|

Feature |

Impact on Clinical Accuracy and Patient Comfort |

|---|---|

|

Improved visibility for venipuncture |

Enhances success rates in locating veins, reducing failed attempts. |

|

Reduced patient discomfort |

Minimizes stress and enhances overall patient satisfaction. |

You will learn practical steps to use these devices for better outcomes.

Vein Visualization Technology

Infrared Projection for Vein Mapping

You can achieve greater accuracy in venipuncture by using vein visualization technology that relies on infrared projection. This method works by emitting safe, near-infrared light onto the skin, which is absorbed differently by blood and surrounding tissue. As a result, veins appear as clear, high-contrast images on the skin surface. A professional vein finder, such as the Vivolight Projection Vein Finder, uses this approach to help you identify veins quickly and confidently.

Infrared projection stands out for its ability to improve first-attempt success rates and reduce patient discomfort. Clinical studies show that infrared-based devices can increase first-attempt success in venipuncture from 40.7% to 74.1%. Pain intensity also drops, and the time needed to place an intravenous line decreases significantly. These benefits make infrared projection a preferred choice for both routine and challenging cases.

|

Technology |

Features |

Applications |

|---|---|---|

|

Infrared Projection |

Real-time imaging capabilities |

Hospitals, clinics, outpatient |

Real-Time Vein Visualization Benefits

Real-time imaging capabilities transform your approach to venipuncture. With a hospital vein finder that projects a live map of veins, you see exactly where to insert the needle, reducing guesswork and minimizing failed attempts. Studies reveal that real-time imaging capabilities can boost first-attempt success rates to 83% and cut the average procedure time from 17 minutes to just 6.6 minutes. Patient satisfaction scores also rise, reflecting a more comfortable and efficient experience.

You benefit from several key advantages when you use a vein visualization device:

-

Improved peripheral intravenous catheterization (PIVC) success rates

-

Enhanced satisfaction for both patients and staff

-

Fewer complications and shorter treatment times

A portable vein finder for nurses or clinicians adapts to different environments, making it easier to deliver high-quality care wherever you work. By integrating vein visualization technology into your daily practice, you ensure better outcomes for your patients and greater confidence in every procedure.

Professional Vein Finder and Clinical Accuracy

Reducing Failed Attempts

You can achieve a significant reduction in failed iv attempts when you use a professional vein finder. This technology projects a real-time map of veins onto the skin, allowing you to see the best sites for venipuncture. Research shows that up to 98% of procedures using augmented reality vein finders succeed on the first attempt. This means you spend less time searching for veins and more time providing care. You also lower the risk of complications that come from multiple needle sticks.

-

You improve your ability to assess vascular sites with greater accuracy.

-

You make more informed decisions, which leads to fewer failed iv attempts.

-

You increase first-attempt success, which boosts your confidence and efficiency.

A professional vein finder adapts to different patient demographics. For example, infrared technology helps you identify veins in patients with higher BMI or those with less visible veins due to age or skin tone. You see more cannulation sites compared to traditional methods, which supports clinical accuracy in diverse populations.

Enhancing Patient Comfort

You enhance patient comfort every time you use a professional vein finder. Patients often feel anxious about venipuncture, especially if they have experienced multiple failed attempts in the past. By increasing first-attempt success, you reduce the number of needle sticks and make the procedure less stressful.

|

Device |

Impact on Patient Comfort |

Success Rate |

Needle Sticks Reduced |

|---|---|---|---|

|

Professional Vein Finder |

Significant improvement for hard-to-locate veins |

Increased first-attempt success |

Reduced likelihood of multiple needle sticks |

You notice that patients report less pain and anxiety when you use vein visualization technology. Nurses also find these devices helpful for difficult veins, which further improves the overall experience. When you minimize discomfort, you build trust and satisfaction with your patients.

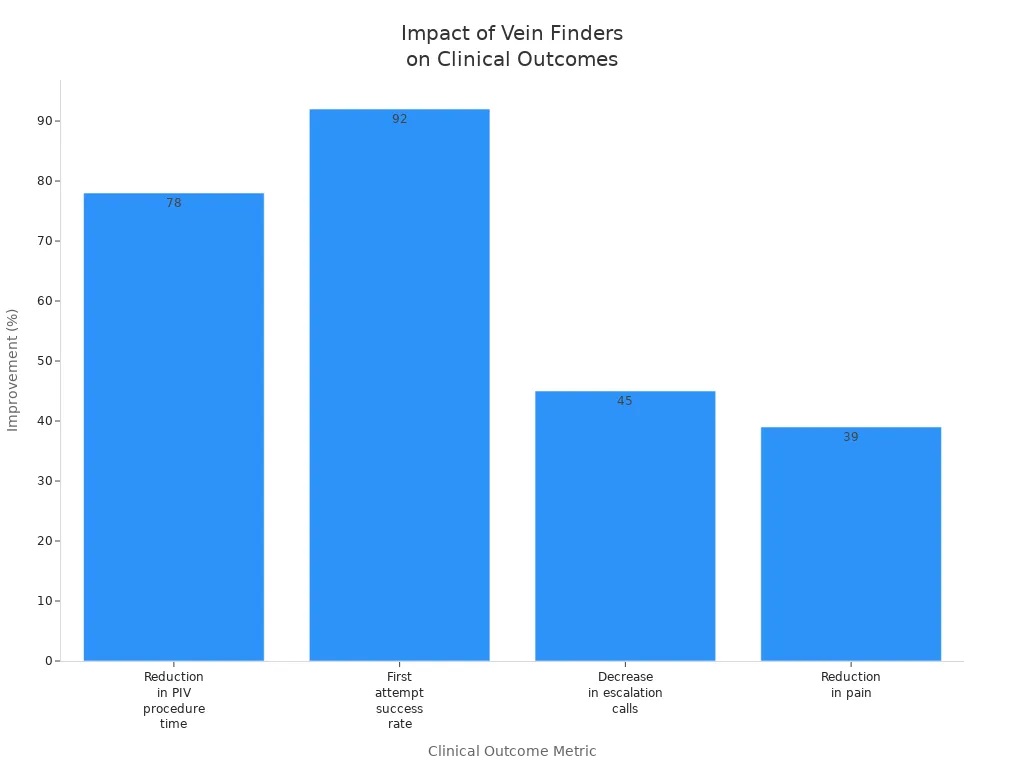

Improving Clinical Outcomes

A professional vein finder does more than just help you find veins. It improves clinical outcomes by reducing procedure time, lowering complication rates, and increasing overall efficiency. You see shorter procedure times, higher first-attempt success rates, and fewer escalation calls for difficult cases.

|

Metric |

Value |

|---|---|

|

Reduction in PIV procedure time |

78% |

|

First attempt success rate |

92% |

|

Decrease in escalation calls |

45% |

|

Reduction in pain |

39% |

You also observe that infants and pediatric patients benefit from lower pain scores and fewer complications, such as infiltration and phlebitis. The average procedure time drops from over six minutes to just over three minutes when you use a professional vein finder. These improvements highlight the value of integrating this technology into your daily practice. You deliver better care, achieve higher clinical accuracy, and ensure greater patient comfort with every procedure.

Venipuncture Steps with Vein Visualization Devices

Achieving accurate venipuncture requires a systematic approach that combines clinical skill with advanced technology. Vein visualization devices, such as the Vivolight Projection Vein Finder V800F and V800P, offer features like infrared projection, portability, and variable brightness. These features support both accuracy and patient comfort throughout the procedure. Here is a practical, step-by-step guide to help you maximize the benefits of these devices.

Preparing Patient and Device

Preparation sets the foundation for a successful procedure. You should always prioritize patient comfort and clear communication. Follow these steps to ensure optimal results:

-

Explain the procedure to the patient and, if applicable, their family. This reduces anxiety and encourages cooperation, especially in children.

-

Select the appropriate vein visualization device for the patient's age, size, and skin tone. The Vivolight models offer various sizes and projection modes, making them suitable for all patient populations.

-

Follow the manufacturer's guidelines for device setup. Adjust the brightness and color settings to match the clinical environment and the patient's skin characteristics.

-

Practice proper hand hygiene and wear gloves to maintain a sterile field.

-

Position the patient's arm comfortably and apply a tourniquet if needed. Encourage the patient to remain still for accurate vein mapping.

Locating Veins with a Professional Vein Finder

Locating the right vein is crucial for successful iv access. The Vivolight Projection Vein Finder uses advanced infrared light technology to project a real-time map of veins onto the skin. This enhances both accuracy and ease of use. The following table highlights best practices for various clinical scenarios:

|

Procedure |

Best Practice Description |

|---|---|

|

Venipuncture |

Use vein visualization devices to locate suitable veins, improving efficiency and reducing discomfort. |

|

IV catheter insertion |

Identify optimal veins for accurate iv access, minimizing attempts and discomfort. |

|

Phlebotomy |

Aid in locating veins for blood draws, enhancing efficiency and success rates. |

|

Blood transfusions |

Ensure precise vein visualization for administering transfusions, reducing complications. |

|

Intravenous medication administration |

Identify veins for medication delivery, minimizing the risk of extravasation. |

|

Chemotherapy |

Locate accessible veins in patients with compromised veins, reducing challenges with needle insertions. |

|

Pediatric procedures |

Make vein location easier for children, reducing stress and improving comfort. |

|

Geriatric care |

Improve success rates in elderly patients with fragile veins through better visualization. |

|

Dialysis |

Identify suitable veins for patients undergoing dialysis, ensuring optimal access. |

|

Anesthesia administration |

Locate veins for anesthesia delivery, enhancing efficiency and comfort. |

|

Emergency medicine |

Rapidly identify veins in emergencies for timely medication or fluid administration. |

The Vivolight V800F and V800P models feature unique smart depth detection and clear fine mode. These features help you align the needle at the correct angle and enhance visibility, even for thin or deep veins. Adjustable brightness and color options ensure accurate detection across different skin tones and lighting conditions. The portable vein viewer design allows you to bring advanced vein visualization to any clinical setting, supporting both hospital and outpatient care.

Performing Accurate Venipuncture

Once you have identified the optimal vein, you can proceed with the venipuncture. Follow this step-by-step protocol to ensure accuracy and patient comfort:

-

Verify the patient's identity and confirm the required tests or treatments.

-

Label all tubes and supplies before starting the procedure.

-

Reassure the patient and encourage them to relax their arm.

-

Apply the tourniquet and use the vein visualization device to confirm vein location.

-

Insert the needle at the recommended angle, using the device's smart depth detection feature for guidance.

-

Collect the sample or administer the treatment as needed.

-

Release the tourniquet and withdraw the needle smoothly.

-

Apply gentle pressure to the site and ensure hemostasis.

-

Label samples immediately and dispose of sharps safely.

The Vivolight Projection Vein Finder's user-friendly design and real-time imaging capabilities support ease of use and clinical accuracy. You reduce the number of failed attempts, minimize patient discomfort, and improve overall outcomes. The portable vein viewer adapts to different environments, making it an essential tool for nurses and clinicians seeking reliable iv access.

Choosing the Right Vein Visualization Device

Key Features for Clinical Accuracy

When you select the best vein finder for your clinical practice, focus on features that directly impact accuracy and efficiency. Devices using near-infrared light technology help you locate superficial veins quickly, which decreases procedure time and supports informed decisions about vein selection. The Vivolight Projection Vein Finder stands out as a professional vein finder, offering advanced infrared projection and smart depth detection. These features improve first-stick success rates and enhance patient care.

Consider the following essential features:

|

Feature |

Description |

|---|---|

|

Brightness Settings |

Multiple brightness levels and color modes allow you to customize visibility for any environment. |

|

Portability |

Lightweight and compact design lets you use the device in various settings, from bedside to outpatient clinics. |

|

Ease of Use |

Simple controls and ergonomic design ensure quick operation, even during urgent procedures. |

Regulatory certifications, such as FDA approval and ISO 13485, confirm the safety and efficacy of the best vein finder models. These standards give you confidence in device performance and reliability.

Adaptability in Different Clinical Settings

Adaptability is crucial when you use a hospital vein finder or a portable vein finder for nurses. You need a device that performs well in emergency rooms, pediatric wards, and outpatient facilities. Portable, wireless, and battery-operated systems offer flexibility, making them ideal for resource-limited environments. Specialized designs for pediatric and geriatric patients address unique challenges, ensuring accurate venipuncture and better outcomes.

-

Portable units enhance mobility and allow you to respond quickly in emergencies.

-

Advanced imaging technologies, such as near-infrared, improve accuracy in difficult cases.

-

Integration with digital systems and AI supports real-time data analysis, boosting clinical efficiency and safety.

You should select a vein visualization device that matches your clinical needs and patient population. The Vivolight Projection Vein Finder adapts to different lighting conditions and skin tones, making it the best vein finder for diverse settings. This adaptability ensures you deliver consistent, high-quality patient care and achieve reliable vascular access every time.